The 2020 Paving 50 contractors generated $832,921,050 in paving-only sales, up substantially from the $493 million in paving-only sales last year, which was down slightly from the $503 million in paving-only sales in 2017.

As noted in the Top Contractor overview, the huge increase reflects the welcome addition to some of the industry’s larger companies to the lists. Their addition, however, makes year-to-year sales volume comparisons difficult, as sales volume blew past historical benchmarks.

But with or without the addition of large companies, paving-only sales continue to dwarf sales of other industry segments, with pavement repair-only sales at $217 million ($209 million last year), followed by striping-only sales at $204 million ($215 million last year), and by sealcoating-only sales at $160 million ($137 million last year).

Total Sales for Paving 50

Total sales for all the work the 2020 Paving 50 did was $1.611 billion. (Total sales of the 2019 Paving 50 was $1.046 billion, up from $962 million in 2017.) Again, while some increase would probably have happened anyway, the jump of more than $500 million reflects the addition of large paving companies to the list.

The 2020 paving-only sales represent 51% of total list sales – up from 47% in 2019 and down from 52% in 2017. This is more than triple the segment-only sales of any of the other segment lists.

The remaining 49% of sales come from a broad mix of other pavement maintenance services:

- 44 companies perform sealcoating work

- 39 companies perform striping (though 14 of those companies generate less than 5% of sales from striping)

- 43 companies perform pavement repair work

The paving list results certainly reinforce the diversity within the industry – in fact, none of the 50 companies on the list performs only paving, though most of the companies on the list generate the lion’s share of their work from paving.

Higher Profit Margins

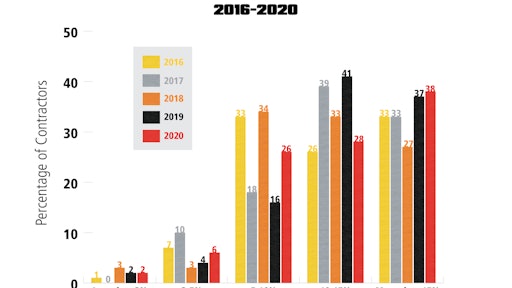

As the chart on this page shows, contractor profit margins within the 2020 Paving 50 continue to fluctuate, with the most dramatic changes coming in the 5-10% and 10-15% ranges. Unfortunately, while those reporting in the largest range of profit margin remained steady, there was a significant decline in margins for more than a quarter of the Paving 50 contractors.

- The percentage of Paving 50 contractors reporting margins greater than 15% remained steady at 38%, gaining 1% from last year

- Contractors reporting margins of 10-15% declined dramatically to 28% from 41% last year

- That decline was picked up by contractors in the 5-10% range, which rose to 26% from 16% last year

- 6% of contractors reported margins in the 3-5% range, up from 4% last year

- 2% reported margins of less than 3%, the same as last year

As the right-leaning chart shows, this reverses a trend of contractors reporting, for the most part, higher margins since at least 2016, though the 5-10% range shows more of an up-and-down movement than any of the other margin ranges.

Where the Paving 50 Work

As in the past, there’s no question that the 2020 Paving 50 emphasize off-road work, with 49 companies (98%) reporting sales from parking lots (none reporting less than 5%) and 38 companies (76%) reporting sales from driveway work (including eight reporting less than 5%). Only two of the 50 companies report any significant amount of highway work and only eight report any highway work at all. And 37 companies (74%) report sales from work on streets.

The Paving 50s’ Customers

- 48 contractors work for commercial/industrial customers

- 45 contractors work for multi-family residential customers

- 39 contractors work for municipal clients

- 27 contractors work for single-family homeowners

Despite the addition of significantly larger companies to the list, these figures remain consistent with past years.

Replacing the Paving 50s’ Equipment

Not surprisingly, 33 of the Paving 50 companies reported it would cost more than $2 million to replace their equipment. Another 10 companies said it would cost between $1 and $2 million, while six companies reported it would cost between $500,000 and $1 million to replace their fleet. No companies reported in the $250,000-$500,000 range, while one company indicated they could replace their fleet for less than $250,000.