As the world recovers from the turbulent years of 2020 and 2021, we are seeing all sorts of repercussions across different sectors of the economy. Unprecedentedly long lead times for durable consumer goods and industrial equipment alike are among these consequences.

With a lack of actual inventory for sale, dealers of material handling equipment (MHE) are seeking new revenue sources and adding rental and retrofit business models to the traditional sales and lease of new equipment. This is where lithium technology can help. The long life cycle of lithium batteries significantly increases equipment utilization so one can extend the use of lift trucks until the new equipment finally arrives.

Lack of inventory and record long lead times in the MHI

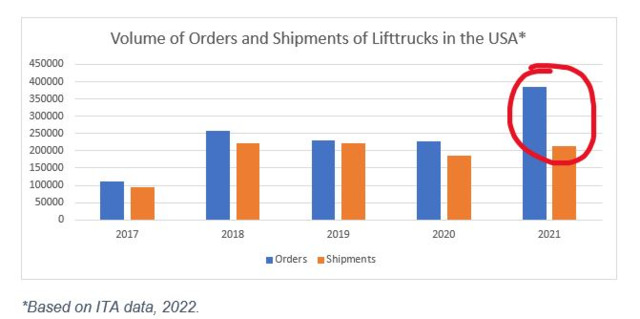

According to the Industrial Truck Association’s data, new orders of MHE rose sharply in 2021, after a slight decline in 2020. However, shipments have not kept pace with these record numbers, showing just a slight rise over the previous year.

As the US economy grew by a healthy 5% in 2021, companies handled more products at factories and moved them to consumers through distributors. Two years into the pandemic, consumers are still buying groceries in bulk, eating more at home, and spending 15–20% more on food and supplies than they did in 2019.OneCharge

As the US economy grew by a healthy 5% in 2021, companies handled more products at factories and moved them to consumers through distributors. Two years into the pandemic, consumers are still buying groceries in bulk, eating more at home, and spending 15–20% more on food and supplies than they did in 2019.OneCharge

Why did the demand for MHE grow so significantly in 2021? There are a few factors at play. As the U.S. economy grew by a healthy 5% in 2021, companies handled more products at factories and moved them to consumers through distributors. Two years into the pandemic, consumers are still buying groceries in bulk, eating more at home, and spending 15%–20% more on food and supplies than they did in 2019, according to the U.S. Labor Department.

But more importantly, we might be seeing a structural change in the supply chain and distribution. The growth of online sales and deliveries pushes warehouses to acquire more space. Many distribution centers and warehousing are quadrupling their capacity.

Equipment manufacturers, however, were not ready for such a spike in demand while they were experiencing rising prices for materials and components. In many cases, “just-in-time” manufacturing turns into “just-in-case.” Rather than keeping their inventory as lean as possible to minimize extra costs, vendors are planning for the unexpected and making upfront investments in more stock to secure their operations in the long term from logistical and supply-chain disruptions.

As a result, the MHE order backlog is bigger than ever in 2022. Lead times have grown from the normal (pre-pandemic) 20–30 weeks to 20, and in some extreme cases up to 30, months. Long waiting lists have been reported by potential customers of Toyota, Crown, Raymond and HYG. Some OEM dealers stopped taking orders in early 2021.

Is there a chance for the second-tier OEM players?

While the market leaders lack inventory, a window of opportunity is opening for second-tier players and Asian brands of forklifts to gain a share and grow their presence on the U.S. market. However, they have the same lack of materials and components and supply-chain disruptions, which is a global issue. Much more importantly, these companies still have to convince the industry they can deliver high-quality service across the U.S. Customers are deterred by difficulties in procuring maintenance, and replacements may take years to arrive.

Lithium batteries can help energize sales for MHE dealers

Industry experts do not expect stability in the supply chain any time soon. Pre-pandemic lead times are not coming back before 2024. In the meantime, many companies are running for longer hours and putting more stress on their forklift batteries, especially in the logistics and 3PL industry. Lead-acid batteries in many applications will not last until the end of the lease term, creating a very real risk that operation disruptions and downtime will spiral out of control.

The following are the solutions that MHE dealers can offer to their customers in 2022–2023 by adopting lithium batteries:

Retrofit

At the end of the lease (or with the visible decline of uptime and increasing maintenance labor costs), lead-acid batteries can be swapped to lithium to keep up operations. This step will improve performance, not just sustain it. When the new trucks finally arrive, the same lithium batteries can be used to power the new equipment.

Rent

The lack of new forklifts to replace equipment reaching the end of its life can be mitigated with the rental model. Advanced lithium batteries with modern data capabilities and triple the lifetime of lead-acid batteries provide dealers with an opportunity to develop an attractive and profitable price model.

Today, forklift dealers have a chance to help their clients with a very practical solution, while at the same time improving their position in the fast-growing lithium segment of industrial batteries. Practical knowledge and experience with the new lithium technology will continue to drive sales for the years to come.