ACT Research recently came out with data on the trucking industry and the inventory cycle. This information can provide a glance into what the next few months of 2024 might look like.

According to the press release:

While trucking demand remains soft overall, rising imports and intermodal trends are key leading indicators of a recovery in trucking this year, according to the latest release of the Freight Forecast, U.S. Rate and Volume OUTLOOK report. Recovering goods demand, inventories, and global ocean shipping disruptions will likely add to U.S. freight movements in 2024 as shippers seek to buffer safety stocks.  ACT Research

ACT Research

“The January surge in rates following the extreme cold mostly reversed quickly as temperatures rose into seasonal market softness, but in late February, seasonally adjusted spot rates were still at six-month highs, excluding the cold snap,” shared Tim Denoyer, ACT Research’s vice president and senior analyst. “With January freight volumes slowed by weather, we see signs the next few seasonally soft months could turn above trend as shippers work to make up lost volumes. The truckload CEOs we interviewed at ACT’s seminar on February 21 are seeing volumes improve enough to get more selective on freight mix, but this demand is not finding its way into the spot market yet.”

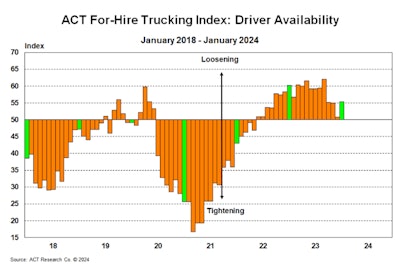

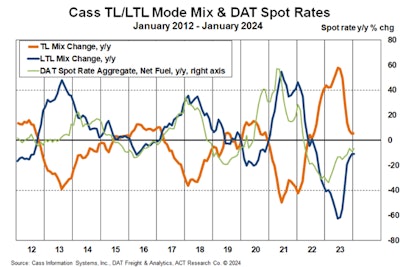

The leading indicators of a change in the cycle’s trajectory include strong intermodal and import trends, which suggest the inventory cycle is turning. However, the freight market remains loose, and while the cold was impactful, it was brief. ACT thinks the improvement in driver availability at the medium and large fleets in ACT’s for-hire survey was partly due to the further exodus of owner-operator capacity.  ACT Research

ACT Research

“For-hire capacity continues to tighten at the margin and fleet capex budgets are sharply lower for 2024. There are certainly pockets of strength, such as in LTL, where capacity additions are likely, but the message of capital discipline from the industry suggests tighter supply this year, as demand begins to recover. The modal mix shifts in the Cass data suggest the cycle is through the worst, but not out of the woods quite yet,” Denoyer concluded.

The monthly 58-page ACT Freight Forecast report provides analysis and forecasts for a broad range of U.S. freight measures, including the Cass Freight Index, Cass Truckload Linehaul Index, and DAT spot and contract rates by trailer type. The service provides monthly, quarterly, and annual predictions for the TL, LTL, and intermodal markets over a two- to three-year time horizon, including capacity, volumes, and rates. The Freight Forecast provides details on the freight rate outlook, helping companies across the supply chain plan with greater visibility and less uncertainty.