Sealcoating-only sales for the 2022 Sealcoating 50 totaled $150,346,312, compared to last year’s $108 million, and $161 million for the 2020 list. As noted in the Top Contractor overview, sales are up in a big way for the Top 50 contractors with nearly $42 million more in sealcoating-only sales (with 25 less companies no less).

Just for historical purposes, the sealcoating-only sales totals for the last few years when the list included 75 companies was $171 million in 2018, $201 million in 2016, and $249 million in 2015. We have previously noted that the high-volume years of 2015 and 2016 likely are the result of pent-up demand and that sealcoating-only totals are settling into a more “normal” level since then. However, last year (COVID) was an anomaly where we saw lower gross sales and profit across all segment lists.

In years past, the sealcoating-only sales trailed all other industry segments. It was up in 2020 as customers chose not to complete other projects that required repair or striping, but this year sealcoating is back down below other lists again. Listed from highest revenue per segment starts with paving-only sales at $742 million ($681 million last year), striping-only sales coming in at $534 million ($99 million last year),* followed by repair-only sales at $247 million ($205 million last year) and finally sealcoating-only sales at $150 million ($108 million last year).

*We are verifying sales of one large striping company which may have skewed numbers.

View All Top 50 Striping Companies Here

Total Sales for the Sealcoating 50

Total sales for all work completed by the 2022 Sealcoating 50 was $1,601,293,233, much higher than $930,805,506 in 2021 and 2020 gross sales numbers which sat

Sealcoating-only sales represents 25% of total Sealcoating 50 sales, up slightly from 24% in 2020. The remaining sales represent a broad mix of pavement maintenance-related work, including:

- 43 companies performing paving work

- 38 companies performing pavement repair work

- 48 companies perform striping work

None of the 50 companies on the list performs only sealcoating with only four companies generating over 75% of sales from this segment of work).

Profit Margins Remain Steady

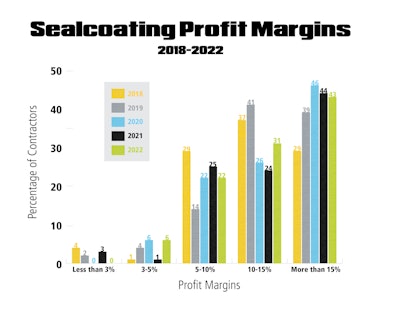

We have seen profit margins remain mostly steady across all segments and the same is true for sealcoating contractors..

- 0% reported margins less than 3% (3% last year)

- 6% report margins between 3-5% (1% last year)

- 22% report margins of 5-10% (25% last year)

- 30% report margins of 10-15% (24% last year)

- 42% report margins of greater than 15%. (44% last year)

Interestingly, the middle-margin range of 5-10% saw a decrease over last year (see graph for visual). We noted last year that 68% of the sealcoating list reported margins of 10% or more, but that has increased this year to 72%.

Where the Sealcoating 75 Work

Consistent with other years and with the sealcoating service, contractors on the sealcoating list emphasize off-road work, with all the companies indicating they generate sales from parking lot work. In fact 18 out of 50 companies (36%) report working over 90% of the time on parking lots. Last year, 24% of companies reported 90% or more of sales from parking lots.

The rest of the time, 48% of companies generate sales from driveway work; 52% report they work on streets; 9% report they work on highways.

The Sealcoating 75s’ Customers

- All 50 sealcoating contractors work for commercial/industrial customers

- 49 contractors work for multi-family residential customers

- 37 contractors work for municipal clients

- 24 contractors work for single-family homeowners

Replacing the Sealcoating 75s’ Equipment

Only five companies reported it would cost less than $500,000 to replace their equipment. Eight reported it would cost $500,000-$1 million to replace their fleet; Nine companies said it would cost $1-$2 million; and 28 companies reported it would cost more than $2 million to replace their equipment.